Buying at Auction: Buyer Beware!

Buying at Auction: Buyer Beware

Before the “bust” in 2008, residential property auctions were generally confined to premium properties and properties which were hard to value. It made sense for sellers to get motivated buyers into a room where they could compete against each other to buy a property. In the heat of the moment people could get carried away and pay over the top for a property. That might be great for a vendor!

Shortly after the "bust", lenders began to repossess properties. Very frequently those properties were offered for sale by public auction. This provided a quick and transparent means of sale, but the properties were often not the usual “auction type” properties. Many were very ordinary.

More often than not, the properties were sold by receivers and many of the usual warranties and assurances were excluded from the contracts with the result that there was more risk for purchasers.

Big auction events in hotel ballrooms attracted lots of media coverage and there was a perception amongst some of those who attended that some properties could be picked up cheaply. Some people picked up bargains. Others were not so lucky.

Most properties in Ireland are sold by private treaty sale. After the sale is agreed, contracts and title documents are sent to the purchaser’s solicitor who reviews them and negotiates changes or additional conditions. You can also send your engineer or architect out to the property to survey it. So, there is no real risk in agreeing to buy a property by private treaty. You get to check it out afterwards and in your own time.

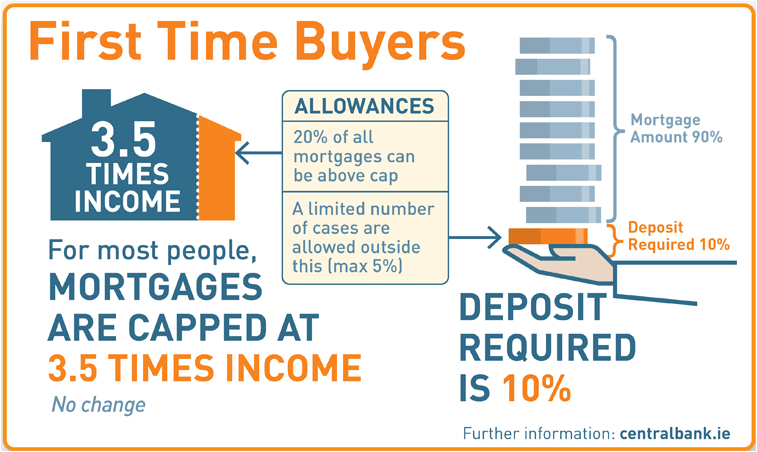

The key difference between an auction and a private treaty sale is that as soon as you are successful at an auction you sign the contract there and then and you are legally bound to purchase the property. It’s too late to check the property out after the auction. You can’t change the contract. If the property is a wreck, you are stuck with it. You normally pay a 10% deposit. If you don’t or can’t complete, you may lose that deposit. You may even be liable for damages for not completing the purchase.

In recent times, auctions have moved online, but the rules are basically the same.

If you are hoping to buy a property at auction, you

- MUST have the contracts checked by a solicitor in advance.

- ABSOLUTELY should get your survey done before the auction

- Should KNOW for certain that you have access to loan finance if you need it

- Need to CHECK, CHECK, CHECK, CHECK everything there is to check about the property IN ADVANCE.

Last year two clients came to us AFTER buying properties at online auctions. In both cases they were already legally obliged to buy the property before they came to us.

In one case the property was severely affected by mica/pyrite but the client hadn’t surveyed the property in advance. In the other case, the property had been repossessed from people allegedly involved in organized crime and who are refusing to leave. The client could have found that out by making local enquiries.

On the other hand, we recently acted for a lovely couple who came to us well in advance of an auction. We were able to check everything out. They got their survey done. There were no issues and they bought the property for a really good price.

Unless the property is a premium or unusual property you should consider why it is being sold by auction. For me, it’s a warning that there might be something wrong. There may not be, but you need to CHECK, CHECK, CHECK in advance of the auction.