2022: 10 Reasons for Optimism

10 Reasons for First Time Buyers to be Optimistic in 2022

In the first week of January every year, my wife asks "can you see the stretch in the evenings?". While the extra few minutes of daylight is barely noticeable (and it's a standing joke in our house), it's her way of showing her optimism for the new year ahead.

There are plenty of reasons to be optimistic if you're a first time buyer: Here's 10 of them.

- There should be lots more house completions this year. That's good news for new house supply.

- The Help to Buy scheme has been extended to 31 December 2022.

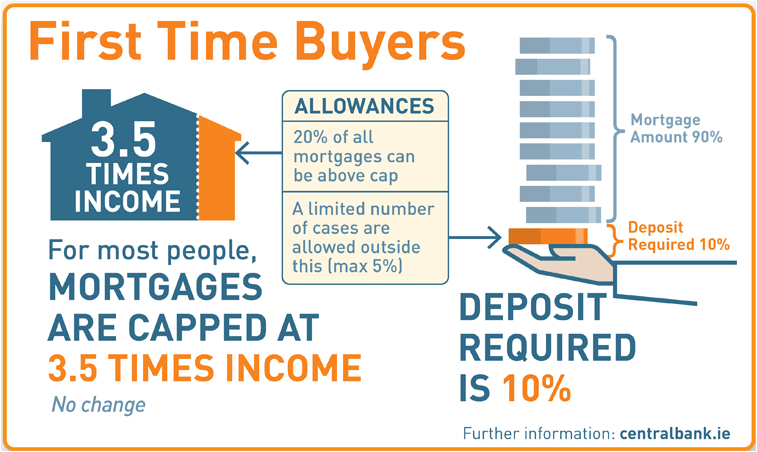

- The lenders have a brand new batch of "exceptions" to hand out if you need one.

- Hybrid working models are affording more choice to where you can live.

- More new non bank lenders like Avant, Finance Ireland and ICS are expected to enter the market making lending more competitive.

- A new grant of up to €30,000 to help people who buy derelict properties to renovate and live in is to be launched.

- A new Government "Shared Equity" scheme is expected to be launched early in the year.

- Some lenders are providing low interest loans for fixed periods of up to 25 years. You can lock in low interest rates for that period.

- An expanded local authority home loan scheme, which seeks to make it easier for people to access State-backed mortgages, was launched on 4th January.

- There is no imminent expectation of a significant rise in interest rates.

If we can suggest one new year's resolution , it is to secure your mortgage Approval in Principle (AIP). Getting a mortgage approval in principle is a step closer to buying your new home. It’s free to get an AIP and it’s usually valid for six months. It can be extended quite easily if your circumstances haven’t changed during that time. Here's a link to a handy guide to AIP from Switcher.ie.

Hopefully 2022 will be a good year for you and yours, and of course we are here for you when you need us.